Alexandria Real Estate Equities, Inc. Reports: 3Q22 and YTD 3Q22 Net Income per Share - Diluted of $2.11 and $2.88, respectively; and 3Q22 and YTD 3Q22 FFO per Share - Diluted, As

Alexandria Real Estate Equities, Inc. Reports: 3Q22 and YTD 3Q22 Net Income per Share - Diluted of $2.11 and $2.88, respectively; and 3Q22 and YTD 3Q22 FFO per Share - Diluted, As

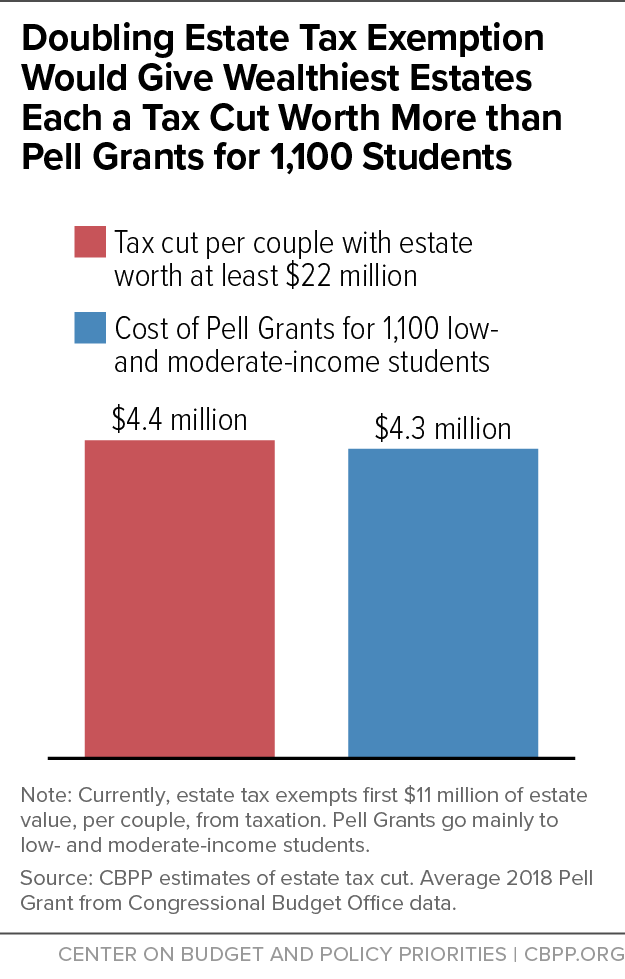

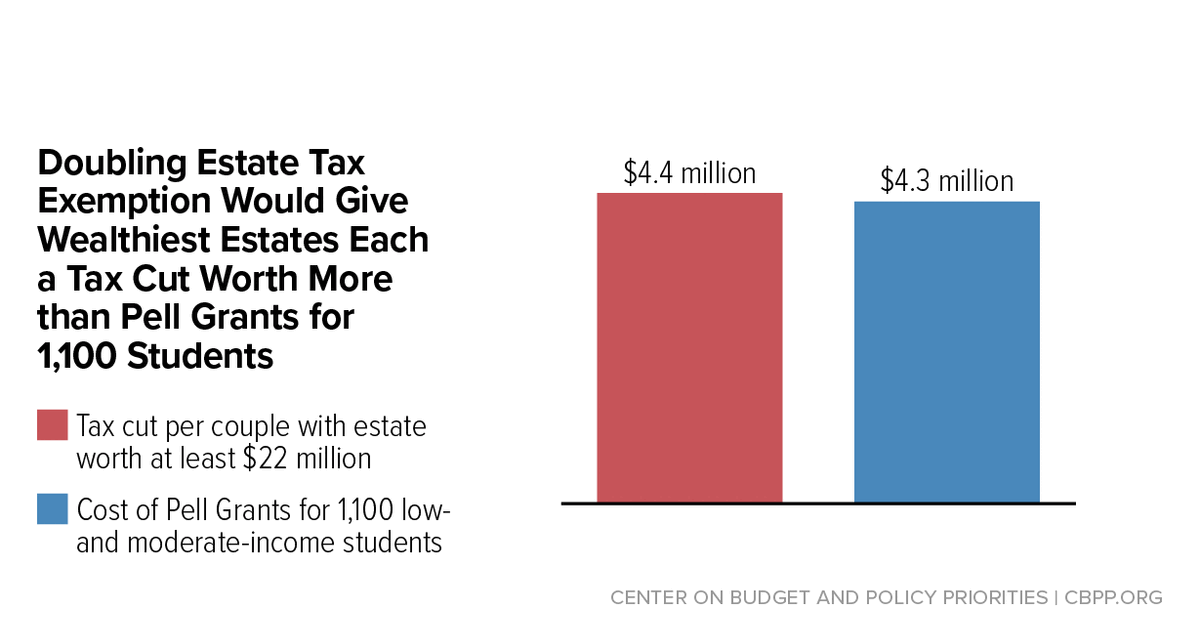

Doubling Estate Tax Exemption Would Give Wealthiest Estates Each a Tax Cut Worth More than Pell Grants fro 1,100 Students | Center on Budget and Policy Priorities

Map of the residents and the per capita nominal monthly income of the... | Download Scientific Diagram

Low Density Development Undermines Infrastructure Funding — Even When Property Values are Very High | by Benjamin Groff | Medium

What's the Difference between Per Stirpes vs. Per Capita in Estate Planning? - Legacy Design Strategies - An Estate and Business Planning Law Firm

Alexandria Real Estate Equities, Inc. Reports: 2Q22 and 1H22 Net Income per Share - Diluted of $1.67 and $0.74, respectively; and 2Q22 and 1H22 FFO per Share - Diluted, As Adjusted, of $2.10 and $4.15, respectively

Doubling Exemption on Estate Tax, Then Repealing It, Would Give Millions to Wealthiest Heirs | Center on Budget and Policy Priorities

Impact of Potentially Higher Estate Taxes and Repeal of Income Tax-Free Basis Step-up at Death - Lion Street